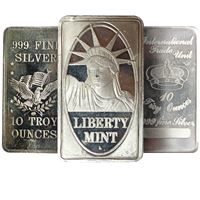

5 oz Morgan Silver Bars 999 Pure | Made In The USA

| Qty | Check / Bank Wire | Credit Card |

|---|---|---|

| 1 - 9 | $170.10 | $176.05 |

| 10 - 24 | $169.85 | $175.79 |

| 25+ | $169.55 | $175.48 |

Product Highlight:

- Five Troy Ounces of .999 Fine Silver

- 99.9% Purity

- Emblazoned With Famous Morgan Head

- Low Premiums Compared to 1oz Coins

Buy 5 oz Morgan Silver Bars 999 Pure | Made In The USA

The 5 oz Morgan Design silver bar brings you pure silver at a lower price per ounce than 1 oz bars, while still being extremely portable and fungible. Each purchase also helps maintain jobs here in the United States. Since the contracted mints making this bar for Gainesville Coins all adhere to the strict international ISO-9001 standard, these bars are eligible for inclusion in your precious metals IRA as well as being suited for your personal collection.

The famous silver dollar design by George T. Morgan was first minted in 1878, by Congressional mandate. Though extremely common during the late 1800s, over 270 million of them were melted down in 1918 to provide Britain with desperately needed silver bullion. Over 50 million more were melted in 1942 for use in the war effort in WWII.

Appreciation for the Morgan dollar grew in the 1950s, and the publicity surrounding the discovery of Morgan dollar hoards in US Treasury vaults in the 1960s, the Redfield Hoard of 1976, and the Continental Illinois Bank Hoard of 1984 propelled the once-unloved Morgan dollar to the status of one of the favorite subjects of modern coin collectors.

History of Silver Bullion

Silver bullion has served as an important means for trade and exchange for thousands of years. Even before the first coins, traders from various ancient civilizations in Eurasia were using large ingots of gold and silver as one of the earliest forms of money.

This historical trend not only spread the concept of silver as a monetary metal, which spread west to Greece and the rest of Europe and appears to have sprung up independently in India, but it also allowed trade and commerce to flourish in these parts of the ancient world. There can be little doubt that the overarching reason that silver was used as money across millennia is because the metal is especially suited for the task.

Like gold, the distinctive luster and special physical properties of silver made it perfect for use as a medium of exchange. It was much more easily portable than other alternatives, and its universal value made trade between disparate nations or empires far more convenient and efficient.

Along with the widespread innovation of coinage, this reliance upon precious metals defined the monetary systems of the world well into the 20th century. It wasn't until the middle of the 1960s, when the price of silver began to appreciate rapidly, that the traditional link between silver and money began to deteriorate.

Silver Bars Become Popular Once Again

Not coincidentally, the period that followed not only saw Americans hoarding silver coins -- which they did in great numbers, even emptying the U.S. Treasury's coffers of millions of Morgan silver dollars when the government started selling them to the public. It also saw the rise of modern silver bars produced by private refineries.

Particularly during the 1970s, a great deal of silver coins and silver flatware were melted down and made into bars. These bars typically had a patriotic, historical, or event-based theme (such as an anniversary, birth of a new child, etc.), along with an artistic design. In more recent decades, new designs and new themes have emerged, but the classic silver bars from an earlier era are still widely traded in the over-the-counter bullion market that operates all over the world.

One of the reasons these bullion bars proliferated was twofold:

1. The U.S. Mint ceased silver coin production in 1964, switching to a much cheaper copper-nickel clad alloy for its existing coin designs. This meant that high-quality silver was less readily available to Americans once the precious metal was removed from circulating coinage.

2. The country was entering a period of economic crisis during the 1970s. In a fairly rare quagmire known as stagflation, the inflation rate was extremely high even as economic growth and employment stagnated.

Surviving Economic Crisis

These two developments combined, along with the skyrocketing price of crude oil due to an embargo against imports from the Gulf States, to erode confidence in the U.S. dollar.

Consequently, the same scenario played out in the United States as has happened countless times in human history: People exchanged their fiat currency (dollars) for silver because precious metals have tangible value and are considered a safe haven during a financial or monetary crisis.

Early on in the crisis, people were lining up at the various branches of the U.S. Mint in order to buy huge bags of 90% silver coins at face value. They also exchanged silver certificates for silver coins, as the government announced it would soon end all redemptions of the certificates (which coincidentally look just like today's unbacked federal reserve notes).

This quickly exhausted the Treasury's surplus of silver coinage. In response, privately minted silver from non-government refineries stepped up in fill in the gap in silver demand.

Because private enterprises are prohibited from minting their own coins (considered counterfeiting), the obvious alternative was silver bars. Silver bars, also known as silver ingots, have traditionally been used as a medium of exchange going back several thousand years.

Reprising the Classic Morgan Dollar Design

It may be surprising to hear that, for all of its mystique, the silver dollar has never been a particularly popular coin in the United States. At least this has historically been the case in terms of regular commercial transactions.

Silver dollars are the largest-sized coins produced by the mint. By the early 20th century, most Americans preferred the convenience of paper bank notes to such hefty coins. By contrast, dollar coins made of gold failed to catch on for the opposite reason: They were too small and prone to being lost.

Thus the birth of the Morgan dollar was not in response to any commercial need for more coins. Instead, it was motivated by industrial interests in the West, where silver mining was a major enterprise. Striking new silver dollars would provide a ready-made outlet for all of the silver produced in Nevada and the surrounding states.

The silver miners were successful in lobbying Congress to authorize the new dollar coins, but lost the political battle of the time between proponents of a pure gold standard (mainly in urban centers) and supporters of a bimetallic standard and free coinage of silver (mainly in the rural west).

The design circulated from 1878 to 1904, and then was struck again for a one-year issue in 1921. In the years between, millions upon millions of Morgan dollars (an estimated 270 million) that were sitting in government vaults were ultimately melted.

As a result, it became the most widely collected U.S. silver dollar -- surpassed in fame only by the legendary 1804 dollars.

The design was created by (and named for) George T. Morgan, who later became the Chief Engraver of the U.S. Mint. Historical research points to a young woman named Anna Willess Williams as the model Morgan used for his portrayal of Lady Liberty. Photographs of Williams appear to confirm the connection.

This image is now iconic among coin collectors. Along with the Walking Liberty design that was later used for the half dollar, the Morgan dollar eventually became a popular theme inspiring the designs of various kinds of privately-minted silver bullion, like these 5 oz Morgan Design silver bars.

The Legacy of the Morgan Dollar

Aside from its classic design, the Morgan dollar looms large in the history of America's relationship with silver. It played an important role in the government's turn toward using fiat policies to reshape the country's monetary system.

The Bland-Allison Act was a contentious piece of legislation that authorized the Morgan dollar. It presaged a heated debate that would take place in the last decades of the 19th century: Should America be on a pure gold standard, or use a bimetallic standard that included silver as an official form of money?

Up to that point, the question had largely gone unanswered. Proponents of each side of the argument had good reason to believe their view was correct.

Bimetallists had both informal tradition and codified law on their side. On the latter point, the original legislation regarding coinage (Coinage Act of 1792) actually defined the U.S. dollar in terms of silver -- 371.25 grains of silver, to be precise. Moreover, silver coins had been minted as legal tender for nearly a century by the time of the Bland-Allison legislation.

However, the supporters of a strict gold standard -- which you might call a "monometallic standard" -- also could make a compelling case for their side of the debate.

They correctly pointed out that the trouble with maintaining a bimetallic standard is the price ratio of the two metals. Any fluctuation in the ratio of gold to silver would encourage speculators to exchange silver coins for gold ones or vice-versa, depending on which metal had become overvalued. This unduly empowered speculators at the expense of normal commercial uses for coins.

Branch Mints in the West

One of the main proponents of bimetallism came from the West, where many of the country's richest silver mines were located, as mentioned earlier. Thus the authorization of the Morgan dollar did not technically alter the gold standard, but it was seen as a major political compromise to western mining interests by guaranteeing that the federal government would be a reliable purchaser of the silver they mined.

These silver dollars didn't actually circulate very much, unfortunately. Most Americans at the time -- and this is still true today -- preferred to convenience of carrying $1 paper notes rather than the heavy coins.

As a result, millions of them sat idle in the vaults of the U.S. Treasury. Later, the vast majority of them were melted down and repurposed as bullion. This destruction of Morgan dollars made the coins much more desirable for collectors during the second half of the 20th century.

Many of the Morgans that were minted at the Carson City (Nevada) branch of the U.S. Mint were discovered, unmelted, by the government agency known as the General Services Administration. Each of these coins can be identified by the "CC" mintmark placed on the lower portion of the reverse design.

The GSA Hoard, as it became known, was progressively sold off to coin collectors through a direct mail promotion that concluded in the early 1980s.

Why Buy Morgan Design Silver Bars?

The 5 oz Morgan Design silver bar is an attractive and practical way to build your silver assets. The purity and quality of this 5 troy ounce bar is guaranteed, because Gainesville Coins only uses ISO 9001-certified private mints located in the United States for its generic silver.

Emblazoned with the weight and purity below a representation of the obverse of the Morgan silver dollar, each bar is proudly marked “Made in USA.” The back of the bar is covered in a diamond grid pattern.

Compared to the original Morgan dollar, these silver bars have more than five times as much pure silver content by weight. Moreover, instead of using the classic coin standard of 90% pure silver, each of these bars is composed of .999 fine silver (in other words, 99.9% pure silver). This not only attests to the high quality of the bars, but also means there is no wasted space with less valuable metals in the alloy, making compact storage of your silver bullion that much more convenient.

Gainesville Coins is proud to offer the 5 oz Morgan Silver Bar (Made In The USA) at exceptional prices that carry a very low premium over spot. This means you are essentially paying the melt price for these silver bars! This is a boon for investors and collectors alike given the beauty and detail of the Morgan dollar design that graces each five-ounce bar. You won't find such high-quality silver bullion for sale at prices that are comparable to generic silver anywhere else!

Don't miss your chance to add .999 fine silver bullion to your investment portfolio or collection with these Morgan silver bars -- and their intriguing backstory.

Specification

Related Products

Customer Ratings & Review

Review This Product

Share your thoughts with other customers.