Platinum Bullion For Sale

- Gold

- Silver

- Platinum

- Palladium

- 1 gram

- 2.5 gram

- 5 gram

- 10 gram

- 50 gram

- 100 gram

- 250 gram

- 1/20 oz

- 1/10 oz

- 1/5 oz

- 1/4 oz

- 1/2 oz

- 1 oz

- 2 oz

- 5 oz

- 10 oz

- 20 oz

- 50 oz

- 100 oz

- 1/2 kilo

- 1 kilo

- 5 kilo

- 10 kilo

Platinum Bullion Coins and Bars For Sale Online

Gainesville Coins is your trusted source for purchasing precious metals at the lowest prices. Orders can be placed online 24/7 or by calling us Monday - Friday at (813) 482-9300 from 9am until 6pm EST.

We accept many different forms of payment including Visa, MasterCard, Discover, American Express, personal & business checks, money orders, cashier's checks, and bank wires.

All of our shipments are sent discreetly with fully insured shipping until the time of delivery.

Gainesville Coins customers enjoy no minimum orders, no cold calls and no commission sales people.

There is no need to worry about the price of gold and silver moving as your prices are locked in at the time of your order.

With over $10 billion dollars in trusted transactions since 2006, Gainesville Coins is one of the most trusted gold and silver bullion dealers worldwide.

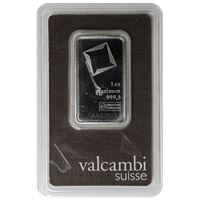

Platinum remains one of the rarest metals in the world. Accordingly, platinum bullion products such as platinum bars and platinum coins are generally quite scarce. These investment products are produced by a small handful of world mints, such as the Royal Canadian Mint and United States Mint, and some prominent private refineries like PAMP Suisse.

Bullion dealers often carry a limited supply of platinum bullion in their inventory. They are simply far less popular than comparable coins and bars made of gold or silver. However, this scarcity of availability is one of the reasons that investors choose to diversify their portfolio with platinum as a long-term investment.

Read more about investing in platinum from the experts at Gainesville Coins. You can also check out our Frequently Asked Questions About Platinum for more information.

Buying Platinum Bullion

Compared to the previous decade, platinum prices are relatively cheap right now. This has more to do with industrial demand for this metal than with anything in the platinum bullion market.

The two most prominent platinum coins are the American Platinum Eagle from the U.S. Mint and Canada's Platinum Maple Leaf coin. Each of these coins is struck from .9995 fine platinum. This means that they are composed of 99.95% pure platinum. Both coins come in sizes of 1 troy ounce (1 oz).

Platinum Eagles and Platinum Maples are each legal tender issued by their respective governments. They are both eligible for inclusion in your individual retirement account (IRA), known as a self-directed IRA. Follow the link to learn more about including platinum, gold, and silver in your IRA.

Precious metals investors tend to prefer buying platinum bullion that comes from major mints. This is understandable considering it is difficult to distinguish between platinum and silver from their visual appearance alone. For this reason, generic platinum bars and rounds are less popular than their name brand counterparts.

Prices for most well-known platinum products will generally be less than 10% above the spot price for the metal. This premium is due to the relative scarcity of platinum coins and bars available in dealer inventories.

You can find out more about how to buy platinum with our helpful buyer's guide.