How to Buy Platinum: Platinum Buyer's Guide

Buying platinum appeals to a growing segment of bullion investors. Both platinum and palladium are what some might call alternative precious metals. That is, they are valuable metals that venture beyond the traditional foothold of silver and gold.

To be sure, platinum is itself nothing new. It's been known for a long time, as the silvery-white metal has been in use since at least 1200 BC. But its popularity as a precious metal and basis for collectible coins has only gained traction since the late 19th and early 20th centuries.

American Platinum Eagle coin (obverse design). The Platinum Eagle has been minted each year since 1997.

It is one of the rarer metals, a natural chemical element 30 times scarcer than gold. One wouldn't necessarily say platinum is better than gold, but it is far less common. Platinum is important for a variety of artistic and industrial uses, including platinum jewelry, pharmaceuticals, and the automobile and electronics industries around the world.

As a rare precious metal, platinum is popular with those who want to diversify their investment portfolios. Platinum is most often encountered in the form of platinum coins, rounds, and platinum bars.

This platinum buying guide will explain the basics about making platinum investments, including:

- how to buy platinum for investment purposes

- where to buy platinum bullion

- the best types of platinum bullion bars and bullion coins to buy

How To Buy Platinum

Thanks to the numerous products available to retail consumers and investors, adding platinum to your precious metals portfolio is easy. If you want to break into buying platinum, you can do so for a relatively small amount. It depends on the prevailing price of platinum and the size and type of platinum product you wish to buy. Some platinum bullion products come in sizes as little as one gram, which may cost between $50 and $75 when the price of platinum per ounce is in the range of $1,025 to $1,050.

You can buy platinum for investment purposes by shopping for it through a bullion dealer. A dealer is a professional or group of professionals who buy and sell precious metals. Choosing a bullion dealer who can supply you with the platinum products you need at a fair price—and while offering prompt and courteous service—is the next step in adding platinum to your portfolio or retirement account.

Other platinum investments come in the form of platinum ETFs, which track the platinum spot price. ETFs don't entitle investors to purchase any physical platinum for delivery, however, such as bullion bars or bullion coins. They are still a popular way to get exposure to the platinum price.

Aside from investment, part of what gives platinum value is its uses in platinum jewelry and the automobile industry. Our cars rely on platinum (and its sister metal, palladium) for the catalytic converters in their exhaust system.

Compared to its all-time high price, many argue platinum is undervalued at its current levels. The majority of the world's platinum is mined in South Africa. If you'd like to read more about what makes platinum so valuable, and yet why platinum is so cheap in 2021, follow the link.

Best Ways & Places to Buy Platinum

Bullion dealers are your source for buying platinum coins, rounds, and bars. But now the search for the right dealer comes down to various other factors you’ll want to vet further. And this goes beyond a simple internet search using terms like “best platinum dealer” or “best place to buy platinum.” Do that, and you’ll probably see a list of umpteen hundred bullion dealers, coin dealers, and precious metals places all vying for your attention.

So, which one is “the best”? You’re going to have to do some legwork. Be sure to check out customer reviews… Which platinum dealers are getting top reviews? What about selection? Remember, the larger and more respected dealers belong to prestigious networks of dealers and can get what you’re looking for if you ask.

Beyond looking through customer reviews and dealer selections, don’t forget to look into the dealer’s customer service and business reputation! You’ll want to deal with a bullion dealer who provides good service and is willing to educate you on what products can best suit your wants and investment goals. Experience and helpful information are hallmarks of a good dealer. Also, be sure the bullion dealer has affiliations with legitimate and respected industry organizations. The National Coin & Bullion Association and the National Inflation Association are good examples.

How to Buy Platinum From Gainesville Coins

Gainesville Coins makes the process of buying platinum simple. Here are a few steps to get started:

- Choose which platinum products you would like to buy. Our available inventory may include coins and bars from a variety of brands, manufacturers, and government mints.

- Select a payment method. Ideally a seller should offer multiple payment methods, including bank wire, check, credit card, or even cryptocurrency. Be wary if a seller only accepts one type of payment, or doesn't accept online orders 24 hours a day.

- Lock in your price. Because precious metal prices are constantly fluctuating, you must finalize your order to lock in the sale price.

- Consider your storage options. Are you planning to store your platinum at home or will you opt for the safer option of vault storage? This decision shouldn't be overlooked with a high-value investment like platinum bullion.

Gainesville Coins should be atop the list of any bullion investor who wants to buy platinum. They have been in business since 2006 and are the trusted source of high quality bullion products at fair prices. They offer convenient online shopping options on their website so you can buy platinum right from the very comfort of your home. Their professionals stand at the ready to answer any questions you may have, whether by phone, email, or in person. Furthermore, Gainesville Coins offers a wide array of platinum coins, rounds, and bars to suit your unique tastes and cater to your individual investment needs. They also provide storage services in a secure vault for customers who want to store their metals off-site.

Best Types of Platinum Products to Buy

There are so many platinum products out there that it might seem overwhelming to know exactly which ones are best for you. So, let’s break down each of the types of platinum products out there so you and what advantages each offer:

Platinum coins – Platinum coins have been struck by a number of government mints, such as the United States Mint or Royal Canadian Mint. Just like gold coins or silver coins, they are struck as a piece of legal tender currency. In other words, it’s money and can theoretically be spent as such. Platinum coins are guaranteed in content and purity (.9995 fine, meaning 99.95% pure) by their issuing government. They are widely recognized by other investors worldwide. Therefore, platinum coins are highly liquid. This is what makes the American Platinum Eagle and American Eagle palladium coins so trusted. However, they also tend to have the highest premium over spot, making them more expensive than platinum rounds or bars, gram for gram.

Platinum rounds – Looking for a more affordable alternative than platinum coins? Consider platinum rounds! They’re generally less expensive to buy than platinum coins and therefore tend to be favored by bullion investors who are looking to get a little more platinum for their money. Platinum rounds are usually made by private mints and are often adorned with artistic designs. Like gold bars or silver rounds, they carry no face value as legal tender. Despite their low premiums, they certainly have resale value.

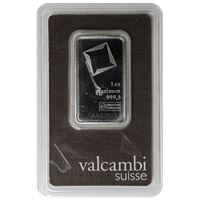

Platinum bars – Usually, the least expensive method of buying platinum comes in the form of bars—often also known as ingots. Platinum bars are generally rectangular in shape and flat, and they can be easily stacked. They come in standard weights, usually ranging from as small as one gram up to one troy ounce (1 oz). Some bars come in even larger sizes, including 10 oz and one kilo (or 1,000 grams). Platinum bars typically have few if any aesthetic design elements, though they are stamped with the mint of issue and a description of the content, weight, and purity. One of the most popular brands for platinum bullion bars is the Swiss refiner PAMP Suisse.

All these platinum products come in an ever-increasing array of designs, sizes, and issuers. Therefore, you should have little trouble finding just the right platinum products for your collecting goals and investment needs. Sticking to popular platinum bullion items is also the only way you can tell real platinum from something fake. Refiners and mints assay every product to ensure its weight and purity.

When you’re ready to buy platinum coins, rounds, and bars, be sure to ask Gainesville Coins about the products they offer. Ask them which ones they recommend for your specific collecting and investing objectives. With so many options out there and such a large selection of platinum items available, you’ll be sure to find the platinum coins, rounds, and bars you’re looking for at a fair price when you to order from choose Gainesville Coins. If you have platinum to sell, they can also provide a platinum appraisal for your items.

Want to buy platinum bullion bars & coins online? Check out the products below or view platinum for sale from available inventory.

Read more precious metals buying guides from Gainesville Coins:

Investing in Platinum - Everything You Need to Know

Beginner's Guide to Investing in Precious Metals

Gold and Silver Stacking: Expert Guide

Buying Gold With Bitcoin: A Simple Guide

product