Gold Bars vs. Gold Coins: Which Should You Buy?

When it comes to buying gold, the decision between gold bars vs. gold coins is a big one. They are the two most popular formats for physically holding gold. The buying decision boils down to your investment goals and collecting objectives: buying gold bars will get you more gold weight per dollar spent, while buying gold coins offers greater resale value per coin.

Put another way, you will pay more upfront for a gold coin than a bar, but each coin has a potentially higher premium on the secondary market if you sell it later.

This trade-off will be explained in greater depth below. We'll also look at the basics of coins and bars. What are the differences? Which ones are more valuable? What's the cost? These are all questions we answer about gold bars vs. gold coins and which ones you should choose based on your gold investing and collecting goals.

What’s a Gold Coin Versus a Gold Bar?

The most important difference is a gold bar is an unmonetized chunk of bullion and a gold coin is a monetized gold piece that was legal tender currency when it was struck. In other words, gold bullion bars are subject to the current gold price, and gold coins have an inherent monetary value.

Beyond that, there are several other differences when considering which one is best for your gold portfolio.

Should You Buy Gold Coins or Gold Bars?

Both gold coins and gold bars provide the same general benefits of owning physical gold. They serve as an inflation hedge, a tangible asset with no counterparty risk, and provide portfolio diversification.

So what is the difference? Short answer: If you care mostly about buying gold at the lowest price, you should buy gold bars. If you want your gold to be legal tender that is potentially collectible, you should buy gold coins. Whichever of these two considerations matter more to you should inform your decision.

.png)

Gold bullion dealers will usually carry both gold coins and gold bars in their inventory.

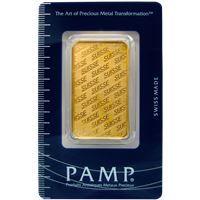

In the long run, gold bars will always be cheaper, by weight, than gold coins. The trade-off is that even gold bars from name brands such as PAMP Suisse or a government mint have a limited upside for secondary-market premiums. The value of a gold bar will always be very close to its melt value based on the gold price. So gold coins are more expensive upfront but they may be worth a significant premium above spot price to a coin collector in the future.

The sections below will explore the differences and similarities between coins and bars in more detail. After considering the various aspects of gold coins or gold bars, you’ll need to figure out which plays better to your hand. Neither bars nor coins necessarily represent a “perfect” set of attributes. It boils down to personal preference.

There’s probably at least one element about either gold coins or gold bars that's appealing. Whether it be a matter of cost, the number of options available, long-term investment, or something else not addressed here.

Ultimately, you need to prioritize the most important factors that relate to your overarching goals, financial position, and personal desires. Then choose the better option for you.

Why Buy Gold Bars?

With the differences between the two in mind, what are the pros and cons? There are advantages and disadvantages to both. Depending on a buyer’s investment needs and circumstances, gold bars or gold coins may be the preferred choice.

It can be difficult to decide, so we break down the pros and cons of each type of gold. Depending on your financial future, financial goals, investment objectives, market conditions, secure storage options, and precious metals industry knowledge and connections, one may be a better gold investment than the other for you.

Gold Bars Pros and Cons

When doing an investment comparison between the two, let’s start with gold bars. A popular choice for high purity and lower premiums, here are some of the pros and cons of gold bars and gold bullion products:

Pros

Cons

Why Buy Gold Coins?

Now for gold coins and gold coin worth. These have their unique advantages and should be evaluated as an investment option whether you're a coin collector or not.

Gold Coins Pros and Cons

Pros

Cons

More Information About Gold Bars and Gold Coins

Gold Bars

Gold Coins

Work with a Dealer to Buy Gold Bars or Gold Coins

Whichever avenue you select, be sure you buy your gold bars or gold coins from a reputable bullion dealer. The dealer should offer what you’re looking for at a fair price and talk you through other competitive options. Some of the most reputable gold bar and gold coin dealers will have the following qualifications:

Work with a reputable dealer who ensures the authenticity of the products they sell and strives for your complete satisfaction, and you’re sure to come out ahead no matter if you buy gold bars or gold coins.

Follow these links to shop for gold coins or shop for gold bars at Gainesville Coins! You can also browse the popular gold products listed here:

Joshua McMorrow-Hernandez is a journalist, editor, and blogger who has won multiple awards from the Numismatic Literary Guild. He has also authored numerous books, including works profiling the history of the United States Mint and United States coinage.

Read more about coins and bullion from the author:

Is Gold a Safe Investment Now?

Silver Coins vs. Silver Bars: Which Is the Better Buy?

Coin Glossary: Most Important Coin Collecting Definitions

Rare Coins Worth Money: A Comprehensive Guide

1943 Steel Penny Value: How Much They Are Worth Now

The Best Gold To Buy: A Straightforward Explanation

product